by The Becerra Group | Mar 10, 2021 | Back Payroll Taxes, payroll taxes

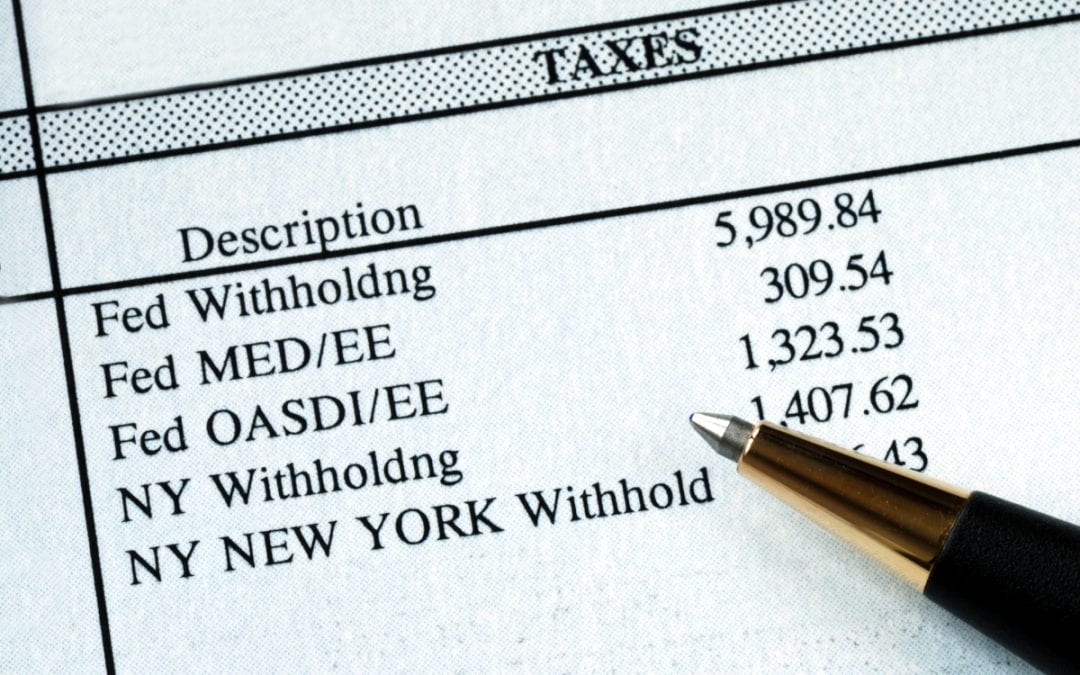

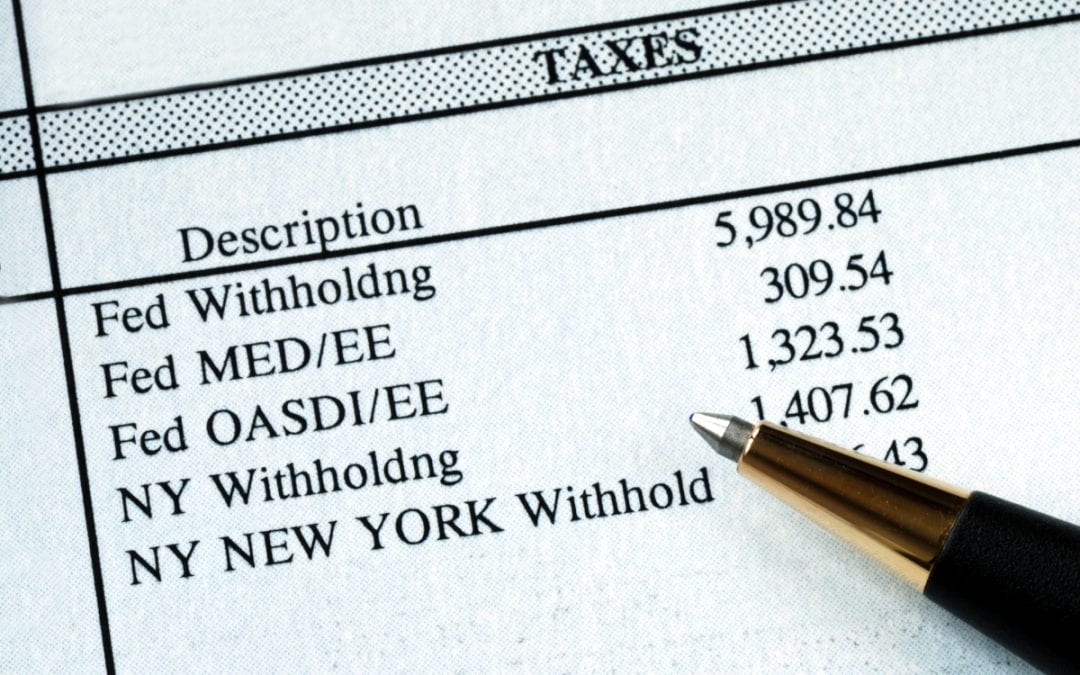

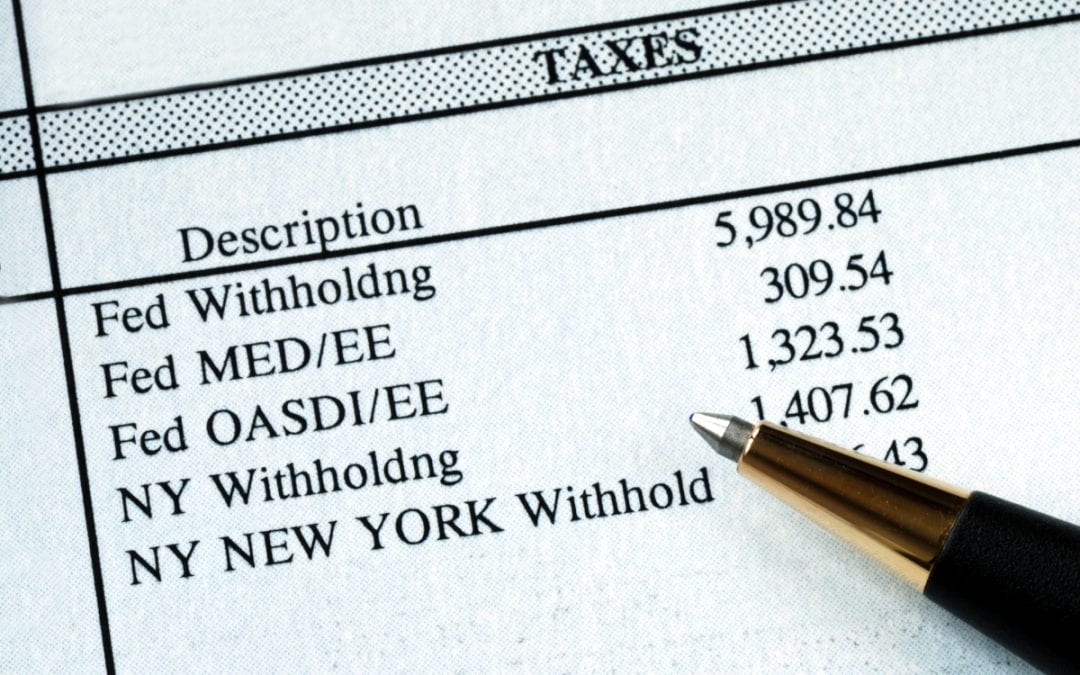

Employers are mandated by law to pay several types of payroll taxes for employees on the company payroll. There are also a significant number of different taxes an employer may withhold from the paychecks of its employees. The cost of these taxes for employers can...

by The Becerra Group | Mar 1, 2021 | Back Payroll Taxes, blog

New Mexico businesses that owe back federal payroll taxes can quickly find themselves in hot water with the IRS. Instead of running away from the problem or even ignoring the issue completely, the smartest action a New Mexico business should take is to address the...