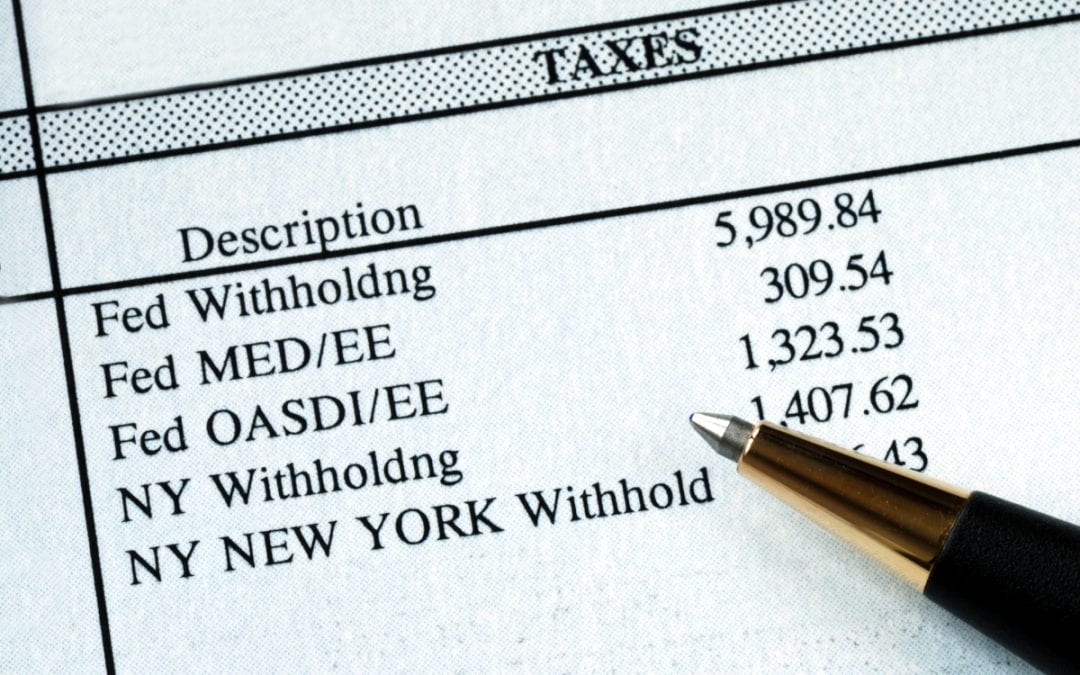

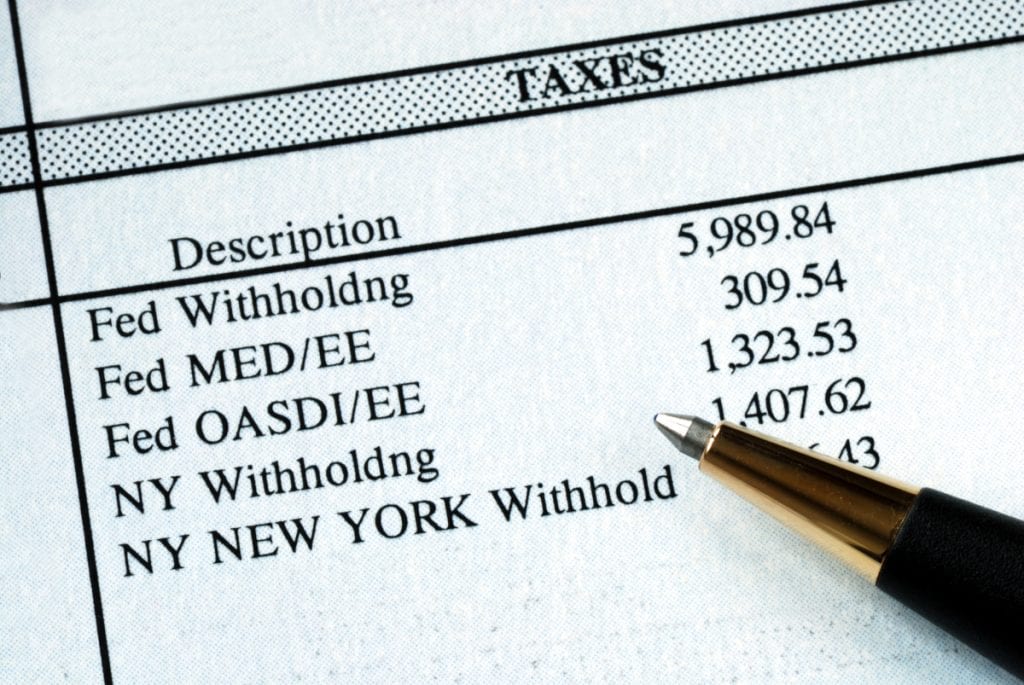

Employers are mandated by law to pay several types of payroll taxes for employees on the company payroll. There are also a significant number of different taxes an employer may withhold from the paychecks of its employees. The cost of these taxes for employers can increase quickly, and employers grappling with payroll tax issues are common. Featured below are the usual payroll taxes employers pay and withhold from employees.

- Federal income taxes (FICA)

- State income taxes

- County, city, and borough taxes

- Matching portion of Social Security taxes (SSI)

- Matching portion of Medicare taxes

- Federal unemployment tax (FUTA)

- State unemployment tax

- State workers’ compensation

- Other related state-mandated payroll taxes

- Railroad retirement taxes (industry specific)

Employers should develop a solid base of knowledge about payroll tax legal requirements and obligations, or they may end up dealing with major payroll tax issues and potentially massive penalties, interest, and even possible prison time because of non-payment.

Payroll Tax Obligation Issues Employers May Encounter

Often described as employment taxes, payroll taxes for employers change from pay period to pay period, relative to the total wages paid. Employers are responsible for deducting the correct amount of taxes from employee paychecks and calculating the total amount of payroll tax expense due from the company. Employers are required to deposit all legally mandated tax deductions to the correct government tax agency on time. Employers are required to pay quarterly and annual taxes as well.

It is easy for an employer to find themselves with payroll tax issues. You might be surprised to learn that even simple errors can cause payroll tax problems:

- Incorrectly calculating the total taxes due from employees.

- Incorrectly calculating the corresponding payment owed by the employer.

- Misinterpreting the payroll tax code and legal responsibility to remit payment.

- Postponing payment of compulsory taxes.

- Incorrectly classifying an employee as freelance/independent contractor.

Employee deducted payroll taxes, employer matching taxes and other employer-paid payroll taxes are nothing to be trifled with. Even a minor, unintended mathematical error can bring on major issues from the IRS and state taxation and revenue agencies. This is why it is critical that employers to assign payroll to a skilled, knowledgeable staff member who is well-versed in payroll taxes, or outsource payroll to a reputable payroll provider.

Trust Fund Recovery Penalty

Payroll taxes historically have been defined as “trust” taxes. That means monies withheld from staff paychecks are retained in trust for payment to the appropriate tax collection agency.

Logically, all monies due to the IRS and state taxation and revenue departments must be paid on time and be 100% correct. Each agency trusts employers to retain the taxes held in a trust fund, therefore, if a tax obligation is not paid when due, the penalties are often substantial and must be taken seriously.

A Trust Fund Recovery Penalty (TFRP) is assessed by the IRS when it cannot collect trust fund taxes and the employer did not pay, no matter if the business is still running or it is not.

TFRP is assessed by the IRS against any party that:

- Is accountable for deduction and payment of income tax withheld and payroll taxes due.

- Is responsible for collecting and paying withheld income and employment taxes.

- Willfully does not deduct taxes due.

- Willfully does not pay taxes due.

The IRS defines willfulness when a “responsible” party:

- Fully knew or should have known of the outstanding taxes; and

- Deliberately ignored the law or was unconcerned about its obligation.

Spending funds held “in trust” to make payments on other business obligations instead of paying employment taxes is direct sign of willfulness.

The IRS’s definition of a “responsible person”

The IRS views a responsible person as “a person or group of people with the duty to perform and the power to direct the collecting, accounting, and paying of trust fund taxes.” This person may be:

- An officer or an employee of a corporation;

- A member or employee of a partnership;

- A corporate director or shareholder;

- A member of a board of trustees of a nonprofit organization;

- Another person with authority and control over funds to direct their disbursement; or

- Another corporation or any third-party payer.

When an employee is instructed by a department head, supervisor, or manager to pay company bills as opposed to making decisions on which obligations or creditor to pay, then that employee is not a “responsible person” as defined by the IRS.

If your business is straining to pay its employment taxes, do not procrastinate to the point where the IRS is sending you notices or coming to your place of business. Do not think that closing your business is an option, because the IRS can (and will) levy the TFRP for past-due taxes on former company owners, officers, and/or other responsible parties. The tax debt, in effect, changes from a company debt to a personal debt. The problem you created for yourself is not going away. Therefore, it pays to be decisive and act to address the issue today. Contact a tax professional, like the tax experts at The Becerra Group, to help you resolve your employer payroll tax issues. Call us at 505-462-9090 (NM) or 830-254-4708 (TX), or click here and complete our online contact form. We are here to serve all your tax, accounting and bookkeeping needs.