New Mexico businesses that owe back federal payroll taxes can quickly find themselves in hot water with the IRS. Instead of running away from the problem or even ignoring the issue completely, the smartest action a New Mexico business should take is to address the debt from a realistic position and act immediately.

Potential Negative Outcome of Back Payroll Taxes

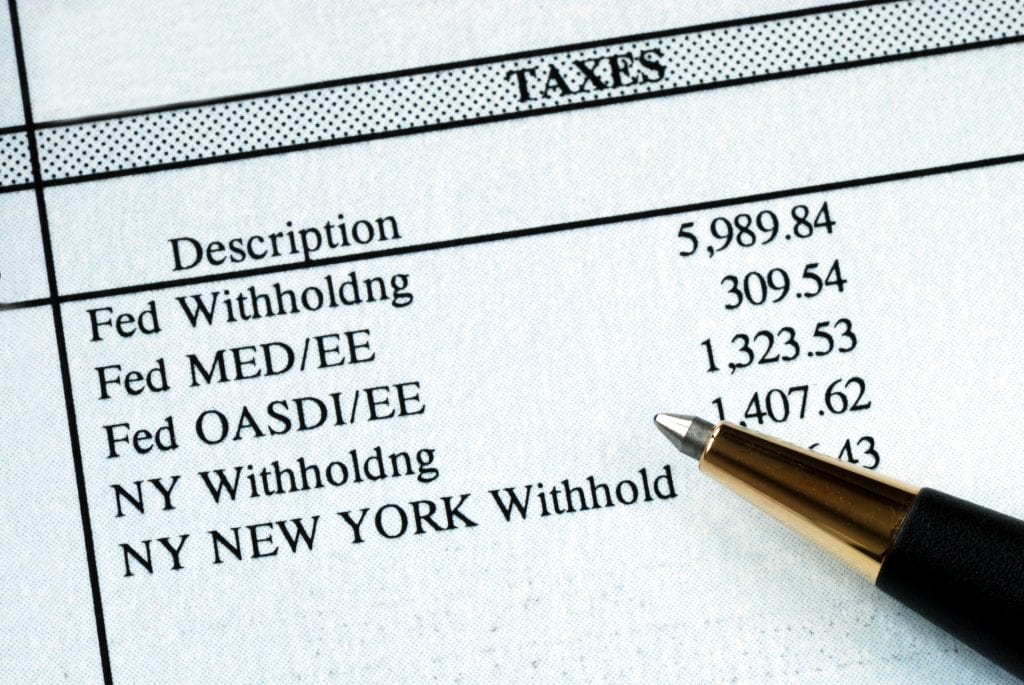

Back payroll taxes are a grave matter to the IRS. The IRS will exhaust all means to obtain what a business owes, including issuing bank levies, seizing vehicles, real estate, and business assets such as intellectual property, inventory, or even stocks and bonds.

The IRS may also file criminal charges against you, the business owner, for failure to pay your back payroll taxes. On top of that potential doom, the IRS has the power to assess massive fines against you and assess penalties as high as 33 percent of your back payroll tax debt.

Potentially the worst outcome may be one where your New Mexico business may be lost completely. The IRS has the power to shut down the business and sell the business itself or the business assets to take care of the obligated back payroll taxes owed by the business. Closing your business is not an escape either. The IRS will simply transfer the responsibility of paying the back taxes from the business to the business owner, who would then be personally liable for repayment of the taxes.

Businesses Sometimes Have Difficulties with Past Due Taxes Through No Fault of Their Own

Did you know that even some of the top businesses in New Mexico and around the U.S. end up owing back payroll taxes? In many instances back payroll taxes are not always due to a mistake caused by the business or its negligence. For example, a primary client of the business may have gone out of business, or there may have been a natural disaster that caused a business interruption.

When there is a loss or revenue due a lost customer or a business interruption, you may have to pay ordinary monthly business expenses with whatever cash you have on hand, which might include undeposited withheld payroll taxes. This means the funds are not available to pay taxes. Likewise, when monthly sales revenues drop and the business income used to pay regular business expenses is not available, payroll taxes can become delinquent. Despite any valid reason for the payroll taxes going unpaid, the IRS requires that payroll taxes paid, no matter what.

Act Immediately

The moment you know your business is obligated for back payroll taxes, your next step should be to address the problem immediately. Evading this debt or blowing it off completely will create a serious set of circumstances you do not want whatsoever.

The impending grave outcomes from the IRS for you not paying your back payroll taxes could include direct employee examinations, potential criminal charges, prison time, and even shutting down your business for good.

You could employ one of the existing methods of repayment such as a monthly payment agreement to pay back what you owe and keep your business from being closed. Another action you need to take is to hire an Enrolled Agent, like the Albuquerque based Enrolled Agent professionals at The Becerra Group, who will assist you with negotiating an installment agreement with the IRS and allow you to keep your business.

Refrain from Communicating with the IRS Yourself

Be sure to not speak to the IRS yourself. It is not uncommon for a business owner to incriminate themself while talking with an IRS agent. The IRS agents are trained to ask engaging questions regarding company workers job functions, hours worked status, among other aspects, all in a conversational manner that may lead you to say more than you should.

When it comes to speaking to the IRS, the smart move is to hire an Enrolled Agent whose job is to provide you with tax resolution services. An Enrolled Agent is a person whose licensure is issued by the US Department of Treasury and is licensed to practice before the Internal Revenue Service. Most Enrolled Agents are degreed accountants and have earned the privilege to represent taxpayers in tax disputes with the IRS. Your Enrolled Agent is knowledgeable about what information should be provided to the IRS and they will not inadvertently incriminate you in actions you have not taken or for anything you do not owe. If you talk to the IRS by yourself several of those negative outcomes may occur. The saying, “better safe than sorry” comes to mind here in a big way.

Hire a New Mexico Enrolled Agent

An Enrolled Agent is your best bet to help you address your goal of squaring away your back payroll taxes. The IRS Collection Division has the power to levy your bank account and seize your company’s assets to collect the back payroll taxes you owe. When you hire an Enrolled Agent, however, they will assist you in putting collections on hold and help you resolve the entire problem. They Enrolled Agent will counsel you on each tax relief repayment program available.

Your Enrolled Agent will be able to advise you about making an Offer in Compromise. If your business meets the guidelines for this program, you may not have to pay the back payroll taxes you owe. Another option your Enrolled Agent will discuss with you if possible is abatement of penalties, which could reduce the total back payroll taxes you owe.

Deposit All Current Payroll Taxes Timely

In order to get the best response possible from the IRS, you will need to make your current payroll tax deposits during your effort to work out a resolution for back payroll taxes with the IRS.

Your current payroll tax deposits must be paid and on time or the IRS may not be willing to discuss a resolution on your back payroll taxes.

In the U.S., with respect to owing the IRS money, you as a taxpayer have legal rights. As a U.S. citizen, information regarding tax resolution choices by law must be provided to you.

It is your inalienable right to employ professional representation when interacting with the IRS. An Enrolled Agent has the skill sets, knowledge, and expertise to be your representative when you are interacting with the IRS.

Working with an Enrolled Agent will allow you to make an informed choice on what resolution methods make the most sense for your business situation. Consider employing The Becerra Group today.