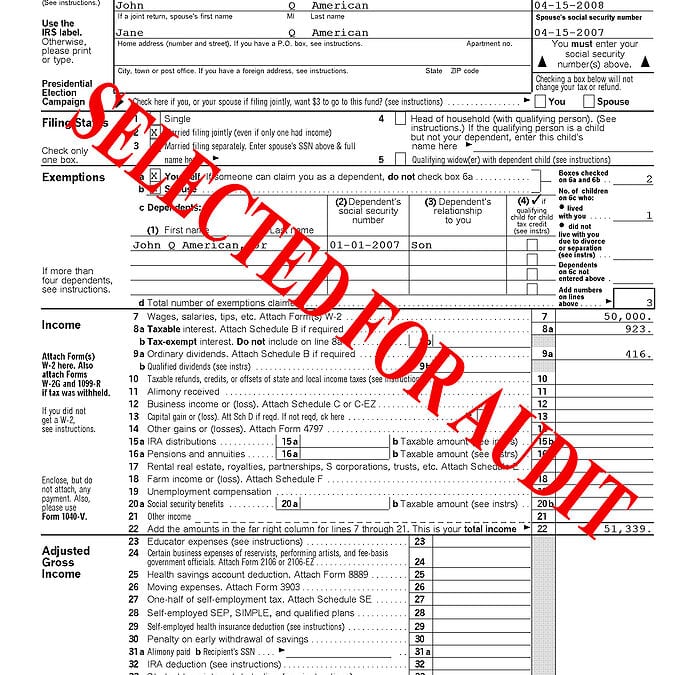

How the IRS performs audits.

Did you know there are three types of audits the IRS does? While most people envision a scary IRS agent showing up on their doorstep to do an audit, the reality is that the IRS utilizes three audit methods: correspondence, office, and field.

The correspondence audit – not so scary.

The correspondence audit is the most common audit method, making up about 75% of audits performed. Correspondence audits are used to request more information about specific items on your tax return or to notify you that the IRS made an adjustment on your tax return (maybe you omitted a form or calculated a total incorrectly). For a correspondence audit, you will usually receive a 566 Letter or a CP2000 notice. The 566 Letter will list the documents the IRS is missing or has questions about. A CP2000 notice is used when the IRS is proposing changes to a tax return that you submitted. Most correspondence audits can be handled by simply sending the missing form or information the IRS has requested.

The office audit – a bit more formal.

An office audit occurs when the IRS has questions about your return that are more detailed or complex, or not easily handled by correspondence. For an office audit, you will be asked to come to an IRS office. Office audits are usually (but not always) focused on issues relating to the more common schedules: itemized deductions (Schedule A), Business profits and losses (Schedule C), or rental income and expenses (Schedule E). The office audit will include questions about the issue under examination, and the audit scope may be expanded depending on the taxpayer’s answers. Most office audits are handled by IRS employees who may or may not have an accounting degree and tend to have minimal (if any) training on the various types of returns they are auditing (partnership, corporation, S-corporation, fiduciary and trust returns).

The field audit – the real deal.

A field audit is the most comprehensive, detailed audit performed by the IRS. It will be handled at the taxpayer’s home or place of business (depending on the type of return being audited). A field auditor usually has an accounting degree and robust training on the type of return being audited. You may also get an auditor who specializes in your industry.

How will you know you are being audited?

The IRS will always notify taxpayers of an audit by mail. ALWAYS. The IRS will never notify you by email or phone, and an agent will not just magically appear at your home or place of business, briefcase in hand. Sometimes the letters will be sent by regular mail, sometimes they are sent certified mail. If you are selected for an office or field audit, you’ll receive an invitation, by mail, to meet with an agent to discuss your tax return.

Don’t ignore letters from the IRS or your state Taxation and Revenue Department.

The first instinct for many is to ignore letters from the IRS or the state. Don’t do it. Ignoring the letter won’t make the issue go away, and could result in higher penalties and interest, and missed deadlines. Ignoring the notice rarely works in your favor. People receive letters from the IRS for many reasons, ranging from inquires for additional information to field or office audit notices. Always open a notice – your letter might even be informing you that your refund is more than you calculated (yes, that really does happen!). But what if your letter isn’t good news?

Decide if you need tax audit representation.

Taxpayers are allowed to have representation in cases of an audit. You might be thinking about now, “just what is tax audit representation?” Tax audit representation, also called audit defense, is a service provided only by an Enrolled Agent, a CPA or attorney. (More on Enrolled Agents here and here.) The representative participates in the audit on behalf of a taxpayer (who could be an individual or legal entity) during an IRS or state tax examination or audit.

Whether or not you need representation will depend on what the IRS needs. Did you receive a 566 Letter asking for a copy of a missing W2 or SSA-1099? You probably don’t need formal representation, you just need to mail a copy of the missing form. On the other hand, did you receive a CP2000 notice of assessment you don’t agree with or a notice that you’ve been selected for an office audit? Obtaining qualified tax representation would be to your benefit.

Organize and document.

Whether you chose to hire representation or not, you will need to gather all the records you used to prepare the return being examined or audited. In cases of office or field audits, you should have all of the information handy, but only provide the documents requested and needed to support your stance. Don’t volunteer any more information than what is requested. Give the auditor copies, never originals, and it’s a good idea to make a list of everything you submit to the IRS or the state taxing agency. You need to understand that you are being investigated and questioned by the IRS because they want to prove you are underreporting your income. All you need to do is convince them that the numbers you reported are correct. Good records will do that.

Don’t get chatty.

An office or field audit is not the time to make new friends. Be pleasant, polite, and professional, but don’t be overly friendly. Tell the IRS what they want to know and nothing more. If you’re asked a “yes” or “no” question, simply answer “yes” or “no”. Period. Don’t elaborate. The last thing you want to do is say more than necessary and potentially give the IRS additional information that could cause the audit scope to be expanded. If you don’t know the answer, simply say so and offer to get back to the agent with the necessary information. Don’t volunteer, but don’t obstruct either.

Ask for copies.

You should ask for copies of the auditor’s files and any documents you signed. If you hired someone to represent you, wait until your representative can review documents before you sign anything. Even better – if you hire professional tax representation, let them talk to the taxing authority for you.

What happens after a tax audit?

After a tax audit, the IRS will present their findings and assess any penalty or tax that you may owe. But what if you don’t agree with the auditor’s findings? You have the right to appeal and settle things out of court. This is where good representation comes into play. Your representative should be familiar with tax law and able to argue in your defense. Should you end up owing even after an appeal, your tax representative can work with the IRS to set up a reasonable payment plan for you.

Get tax audit representation from The Becerra Group.

When you are under an IRS audit, it is always advisable to get representation even if you have done nothing wrong. Hiring an Enrolled Agent, attorney, or CPA to represent you in front of the IRS during an audit is far better than going it alone.

The Becerra Group has represented many clients since it opened for business, both personal and business organizations. When you hire The Becerra Group to represent you before the IRS, we will have your case prepared and ready to go. You will be ensured you are protected because we know your rights and will not let them get violated. Call us at 505-462-9090 (NM) or 830-254-4708 (TX), or click here and complete our online contact form.